Section 806 prohibits retaliation against employees who report shareholder fraud, including securities violations.

Sarbanes-Oxley Act Whistleblower Protections

Sarbanes-Oxley Act Whistleblower Protections: What Employees Need to Know

The Sarbanes-Oxley Act of 2002 (“SOX”) was enacted to combat corporate financial misconduct and restore public trust in U.S. markets. SOX imposed strict reforms on publicly traded companies following high-profile scandals involving Enron, WorldCom, and Tyco.

A key feature of the law is its whistleblower protection provision under 18 U.S.C. § 1514A (“Section 806”), which shields employees who report certain types of fraud from retaliation.

What Is the Sarbanes-Oxley Act?

SOX is a federal law that applies to publicly traded companies and their affiliates. Its primary purpose is to ensure the accuracy of corporate disclosures and protect investors from fraudulent financial reporting.

Key provisions include:

- Section 302 – Certification of financial reports by CEOs and CFOs

- Section 404 – Requirements for internal controls over financial reporting

- Section 806 – Whistleblower protection

- Creation of the PCAOB – Oversight of external auditors

Whistleblower Protections Under SOX

Section 806 protects employees who report conduct they reasonably believe constitutes:

- Securities fraud

- Mail fraud

- Wire fraud

- Bank fraud

- Violations of SEC rules or federal laws related to shareholder fraud

Covered individuals include employees of:

- Public companies (issuers under Section 3 of the Securities Exchange Act of 1934)

- Wholly owned subsidiaries

- Contractors, subcontractors, and agents of public companies

Remedies for retaliation:

- Reinstatement with the same seniority status

- Back pay with interest

- Compensatory damages (including emotional distress and reputational harm)

- Attorneys’ fees and litigation costs

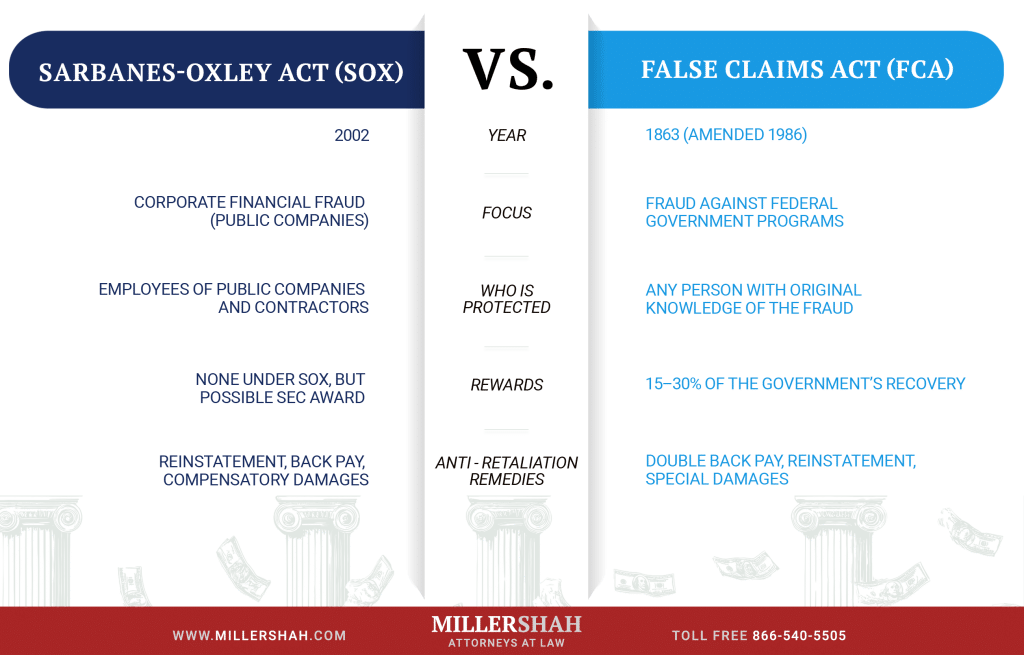

How SOX Compares to the False Claims Act (FCA)

Both SOX and the FCA are essential federal laws protecting whistleblowers, but they operate in different arenas. SOX protects investors and markets; the False Claims Act (31 U.S.C. §§ 3729–3733) protects taxpayers and government funds.

Recent Legal Update: Murray v. UBS Securities, LLC

In a key 2024 decision, Murray v. UBS Securities, LLC, the U.S. Supreme Court ruled that whistleblowers under SOX do not need to prove retaliatory intent by their employer. Instead, they must only show that their protected activity was a contributing factor to an adverse employment action.

Impact: The Murray decision lowers the burden of proof for whistleblowers and strengthens protections under Section 806.

SOX and SEC Whistleblower Rewards (via Dodd-Frank)

Although SOX does not provide direct financial incentives for whistleblowers, individuals may still receive substantial monetary awards under the Dodd-Frank Act if they report violations to the U.S. Securities and Exchange Commission (“SEC”).

To qualify:

- The information must be original and lead to an enforcement action with sanctions exceeding $1 million.

- Awards range from 10% to 30% of the monetary sanctions collected.

SOX and FCA: Complementary Safeguards Against Fraud

SOX and the False Claims Act (“FCA”) serve different constituencies but share a unified purpose: promoting transparency and accountability.

- SOX protects shareholders and financial markets

- FCA protects taxpayers and government funds

In many cases—especially involving publicly traded government contractors—both laws may apply, and dual protections can be leveraged.

Future of Corporate Fraud Compliance

Emerging trends:

- AI-driven auditing and fraud detection: Companies are increasingly using real-time monitoring tools to flag irregularities.

- Expansion of SOX-like requirements: Laws governing ESG disclosures, cybersecurity, and data privacy may soon carry similar internal control requirements.

- Global influence: SOX principles are being adopted in other jurisdictions as models for investor protection.

What Happens During a Case?

In many instances, False Claims Act cases are filed with the U.S. Attorney General’s office or the DOJ, with Miller Shah lawyers taking the lead or acting as an adjunct to the federal authorities. In some circumstances, we represent the whistleblower in prosecuting the qui tam action independently of the government investigation. Whistleblowers may have approached the federal or state government with information about illegal activity, but they should hire us if they need private representation. We work alongside federal or local prosecutors and protect clients’ interests during the case instead of focusing on a conviction.

Why Does Our Work Matter?

The federal False Claims Act has proved to be an effective and powerful tool in fighting Medicare and Medicaid fraud, defense contractor fraud, and other types of fraud perpetrated against the federal government. The qui tam provisions, which allow whistleblowers to file False Claims Act lawsuits against companies and individuals that defraud the government, have been a key ingredient in the False Claims Act’s success, as the federal government has recovered more than $62 billion as a result of qui tam lawsuits since 1986, with whistleblowers’ rewards totaling more than $2.5 billion. In 2019 alone, the government recovered $3 billion through these claims.

Whistleblowers are doing the right thing by coming forward. The money recovered by the government could help people get back to their normal lives and help deter illegal activity in the future. Whistleblowers have prevented more heartache for corporate employees, private citizens, and investors. They deserve that same peace of mind, and we will stand with them every step of the way.

Miller Shah’s attorneys have represented whistleblowers in several significant cases under the False Claims Act. In addition, the firm has significant experience representing clients in qui tam cases brought under similar state laws against companies and individuals accused of defrauding state and local government agencies. The firm currently represents clients in a number of qui tam actions under the False Claims Act and state law, many of which are “under seal.”

SOX FAQ

What is Section 806 of SOX?

Can I receive a reward for reporting under SOX?

Not directly under SOX, but you may be eligible for a reward under the SEC’s whistleblower program if the reported misconduct falls under SEC jurisdiction.

How do I file a retaliation claim under SOX?

You must file a complaint alleging retaliation with the Occupational Safety and Health Administration (“OSHA”) within 180 days of the retaliatory action.

What types of misconduct are covered by SOX whistleblower protections?

SOX protects employees who report conduct they reasonably believe constitutes fraud against shareholders, securities violations, mail or wire fraud, bank fraud, or violations of SEC rules and regulations.

Who is covered by SOX whistleblower protections?

SOX applies to employees of publicly traded companies, their subsidiaries and affiliates, and certain contractors, subcontractors, and agents who perform work for these companies.

What remedies are available if I win a SOX retaliation claim?

Successful claimants may receive reinstatement to their former position, backpay with interest, compensation for special damages (including litigation costs and attorney’s fees), and other equitable relief.

What is the statute of limitations for a SOX whistleblower retaliation claim?

A complaint must be filed with OSHA within 180 days of the alleged retaliation. If OSHA does not issue a final decision within 180 days, the complainant may bring the claim in federal court.

Does SOX protect internal reporting or only external reporting to regulators?

SOX protects both internal reports (to supervisors, compliance departments, or audit committees) and external reports to government agencies, as long as the employee reasonably believes the conduct violates SOX-related laws or regulations.

Speak With a Whistleblower Attorney

If you are considering reporting corporate misconduct or have experienced retaliation after doing so, consulting an experienced whistleblower attorney is essential. Your rights under SOX and related statutes are time-sensitive and complex.

Miller Shah LLP represents employees, executives, auditors, and insiders in whistleblower matters under SOX, the FCA, and other federal and state laws. All consultations are confidential.

Over 1 BILLION Recovered

Our team is equipped and prepared for complicated, high-stakes cases in all areas of business and civil litigation. We continuously strive to achieve the best possible results for our clients.

Eversource Energy ERISA Class Action Settlement

$14 Million

Eversource Energy ERISA Class Action Settlement

Universal Health Services ERISA Class Action Settlement

$12.5 Million

Universal Health Services ERISA Class Action Settlement

Beth Israel Medical ERISA Class Action Settlement

$2.9 Million

Beth Israel Medical ERISA Class Action Settlement

Rush University Medical ERISA Class Action Settlement

$2.9 Million

Rush University Medical ERISA Class Action Settlement

Contact

Miller Shah LLP

While this website provides general information, it does not constitute legal advice. The best way to get guidance on your specific legal issue is to contact a lawyer. To schedule a meeting with an attorney, please call 866-540-5505 or complete the intake form to email us. To inquire about employment opportunities with Miller Shah LLP, please see our Opportunities page.

Alec J. Berin - Partners

PA Philadelphia | 866-540-5505

Alfonso Vilaboa - Of Counsel

NY New York City | 866-540-5505

Ana Barba - Project Analyst

NY New York City | 866-540-5505

Anika S. Keuning - Project Analyst

NY New York City | 866-540-5505

Anna D’Agostino - Associate

NY New York City | 866-540-5505

Betsy Ferling-Hitriz - Legal Assistant

CT Chester | 866-540-5505

Bruce D. Parke - Partners

PA Philadelphia | 866-540-5505

Caroline Soper - Project Analyst

NY New York City | 866-540-5505

Christopher A. Miller - Associate

PA Philadelphia | 866-540-5505

Deborah C. England - Of Counsel

CA San Francisco | 866-540-5505

Elena M. DiBattista - Legal Assistant

FL Fort Lauderdale | 866-540-5505

Elise M. Wilson - Project Analyst

NY New York City | 866-540-5505

Eric L. Young - Of Counsel

PA Philadelphia | 866-540-5505

Gina S. Demetriades - Office Staff

CT Chester | 866-540-5505

Heidi A. Wendel - Of Counsel

NY New York City | 866-540-5505

Henry Fina - Project Analyst

PA Philadelphia | 866-540-5505

Isack Fadlon - Of Counsel

CA Los Angeles | 866-540-5505

James C. Shah - Partners

CA Los Angeles | 866-540-5505

James E. Miller - Partners

CT Chester | 866-540-5505

Jasmine Griswold - Legal Assistant

CT Chester | 866-540-5505

Jayne A. Goldstein - Partners

FL Fort Lauderdale | 866-540-5505

Jillian M. Lussier - Office Staff

CT Chester | 866-540-5505

Jocelyn McNamara - Law Clerk

NY New York City | 866-540-5505

Johanna C. Richter - Law Clerk

PA Philadelphia | 866-540-5505

Jonathan A. Dilger - Office Staff

NY New York City | 866-540-5505

Katie Edwards - Legal Assistant

PA Philadelphia | 866-540-5505

Kolin C. Tang - Partners

CA San Diego | 866-540-5505

Kyla Golding - Project Analyst

PA Philadelphia | 866-540-5505

Laurie Rubinow - Partners

CT Chester | 866-540-5505

Leanne Alvarado - Project Analyst

NY New York City | 866-540-5505

Madison A. Gregg - Associate

NY New York City | 866-540-5505

Marialisa Samo - Legal Assistant

CA San Diego | 866-540-5505

Mark Xiao - Associate

NY New York City | 866-540-5505

Matthew P. Suzor - Associate

PA Philadelphia | 866-540-5505

Natalie Finkelman Bennett - Partners

PA Philadelphia | 866-540-5505

Nathan C. Zipperian - Partners

FL Fort Lauderdale | 866-540-5505

Nicholas Day - Of Counsel

NJ Hoboken | 866-540-5505

Nicholas K. Ono - Project Analyst

NY New York City | 866-540-5505

Nicole Jefferson - Project Analyst

PA Philadelphia | 866-540-5505

Quintin C. Cerione - Project Analyst

PA Philadelphia | 866-540-5505

Raffaele Scalcione - Of Counsel

IT Milan | 866-540-5505

Robert W. Biela - Staff Attorney

PA Philadelphia | 866-540-5505

Ronald S. Kravitz - Of Counsel

CA San Francisco | 866-540-5505

Rrita Osmani - Associate

CT Chester | 866-540-5505

Shuping Li - Law Clerk

NY New York City | 866-540-5505

Stephen T. Rutkowski - Law Clerk

CT Chester | 866-540-5505

Sue Moss - Legal Assistant

PA Philadelphia | 866-540-5505

Sydney D. Finlay - Associate

CA San Diego | 866-540-5505

Tara Gideon - Office Staff

PA Philadelphia | 866-540-5505

Tina Moukoulis - Staff Attorney

PA Philadelphia | 866-540-5505

Tracy Feldman - Office Staff

PA Philadelphia | 866-540-5505

Zacky P. Rozio - Of Counsel

CA Los Angeles | 310-203-0600